Pearson

- Introduction

- Strategy

- Performance

- Responsibility

- Governance

- Financials

- Other info

- Always learning

Long-term incentives

We are asking shareholders by separate resolution to approve the renewal of the long-term incentive plan first introduced in 2001 and renewed again in 2006. Full details are set out in the circular to shareholders.

The committee has reviewed the operation of this plan in light of the company’s strategic goals. The committee has concluded that the plan is achieving its objectives and, looking forward, will continue to enable the company to recruit and retain the most able managers worldwide and to ensure their long-term incentives encourage outstanding performance and are competitive in the markets in which we operate.

We are therefore seeking approval of its renewal on broadly its existing terms. Subject to shareholders’ approval, executive directors, senior executives and other managers can participate in this plan which can deliver restricted stock and/or stock options. Approximately 6% of the company’s employees currently hold awards under this plan.

The aim is to give the committee a range of tools with which to link corporate performance to management’s long-term reward in a flexible way. It is not the committee’s intention to grant stock options in 2011 or for the foreseeable future.

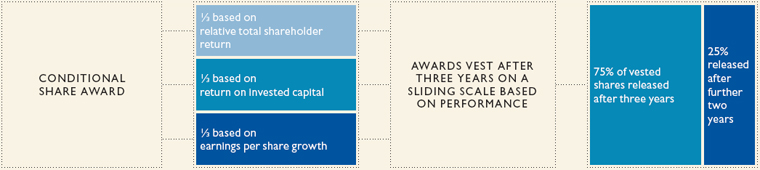

Restricted stock granted to executive directors vests only if stretching corporate performance targets over a specified period have been met. Awards vest on a sliding scale based on performance over the period. There is no retesting.

Performance measures

The committee determines the performance measures and targets governing an award of restricted stock prior to grant.

The performance measures that will apply for the executive directors for awards in 2011 and subsequent years will continue to be focused on delivering and improving returns to shareholders. These measures, which have applied since 2004, are relative total shareholder return (TSR), return on invested capital (ROIC) and earnings per share (EPS) growth.

Total shareholder return is the return to shareholders from any growth in Pearson’s share price and reinvested dividends over the performance period. For long-term incentive awards, TSR is measured relative to the constituents of the FTSE World Media Index over a three-year period. Companies that drop out of the index are normally excluded i.e. only companies in the index for the entire period are counted.

Share price is averaged over 20 days at the start and end of the performance period, commencing on the date of Pearson’s results announcement in the year of grant and the year of vesting. Dividends are treated as reinvested on the ex-dividend date, in line with the Datastream methodology.

The vesting of shares based on relative TSR is subject to the committee satisfying itself that the recorded TSR is a genuine reflection of the underlying financial performance of the business.

The committee chose TSR relative to the constituents of the FTSE World Media Index because, in line with many of our shareholders, it felt that part of executive directors’ rewards should be linked to performance relative to the company’s peers.

Return on invested capital is adjusted operating profit less cash tax expressed as a percentage of gross invested capital (net operating assets plus gross goodwill).

We chose ROIC because, over the past few years, the transformation of Pearson has significantly increased the capital invested in the business (mostly in the form of goodwill associated with acquisitions) and required substantial cash investment to integrate those acquisitions.

Adjusted earnings per share is calculated by dividing the adjusted earnings attributable to equity shareholders of the company by the weighted average number of ordinary shares in issue during the year, excluding any ordinary shares purchased by the company and held in trust (see note 8 of the financial statements for a detailed description of adjusted earnings per share).

Since 2008, EPS growth has been calculated using the point-to-point method. This method compares the adjusted EPS in the company’s accounts for the financial year ended prior to the grant date with the adjusted EPS for the financial year ending three years later and calculates the implicit compound annual growth rate over the period.

We chose EPS growth because strong bottom-line growth is imperative if we are to improve our TSR and our ROIC.

Pearson’s reported financial results for the relevant periods are used to measure performance.

The committee has discretion to make adjustments taking into account exceptional factors that distort underlying business performance. In exercising such discretion, the committee is guided by the principle of aligning shareholder and management interests. Restricted stock may be granted without performance conditions to satisfy recruitment and retention objectives. Restricted stock awards that are not subject to performance conditions will not be granted to any of the current executive directors.

Performance targets

We will set targets for the 2011 awards that are consistent with the company’s strategic objectives over the period to 2013 and that are no less stretching than in previous years. Full details of the performance targets for 2011 will be set out in the circular to shareholders on the renewal of the plan and in the report on directors’ remuneration for 2011.

Value of awards

Our approach to the level of individual awards takes into account a number of factors.

First, we take into account the face value of individual awards at the time of grant assuming that the performance targets are met in full. Secondly, we take into account the assessments by our independent advisers of market practice for comparable companies and of directors’ total remuneration relative to the market. And thirdly, we take into account individual roles and responsibilities, and company and individual performance.

Future awards

For awards beyond 2011, the committee may use the same performance measures and targets, or apply different ones that are consistent with the company’s objectives and which it considers to be similarly demanding. The committee also has the flexibility to vary individual award levels.

The committee will consult with shareholders before making any significant changes to its approach to, or policy on, performance measures or targets or the range of award levels established by awards in recent years.

Dividends

Where shares vest, in accordance with the plan, participants also receive additional shares representing the gross value of dividends that would have been paid on these shares during the performance period and reinvested.

Retention period

We encourage executives and managers to build up a long-term holding of shares so as to demonstrate their commitment to the company.

To achieve this, for awards of restricted stock that are subject to performance conditions over a three-year period, a percentage of the award (normally 75%) vests at the end of the three-year period. The remainder of the award (normally 25%) only vests if the participant retains the after-tax number of shares that vest at year three for a further two years.

All of the executive directors hold awards under the long-term incentive plan. Details are set out in table 4 on pages 82 to 84 and itemised as b or b*.

Outstanding awards

Details of awards made, outstanding, vested and held or released under the long-term incentive plan are as follows (subject to audit):

| Date of award | Share price on date of award | Vesting date | Performance measures (award split equally across three measures) | Performance period | Payout at threshold | Payout at maximum | Actual performance | % of award vested | Status of award |

|---|---|---|---|---|---|---|---|---|---|

| 03/03/10 | 962.0p | 03/03/13 | Relative TSR | 2010 to 2013 |

30% at median | 100% at upper quartile |

– | – | Outstanding |

| ROIC | 2012 | 25% for ROIC of 8.5% |

100% for ROIC of 10.5% |

– | – | Outstanding | |||

| EPS growth | 2012 compared to 2009 |

30% for EPS growth of 6.0% |

100% For EPS growth of 12.0% |

– | – | Outstanding | |||

| 03/03/09 | 654.0p | 03/03/12 | Relative TSR | 2009 to 2012 |

30% at median | 100% at upper quartile |

– | – | Outstanding |

| ROIC | 2011 | 25% for ROIC of 8.5% |

100% for ROIC of 10.5% |

– | – | Outstanding | |||

| EPS growth | 2011 compared to 2008 |

30% for EPS growth of 6.0% |

100% for EPS growth of 12.0% |

– | – | Outstanding | |||

| 04/03/08 | 649.5p | 04/03/11 | Relative TSR | 2008 to 2011 |

30% at median | 100% at upper quartile |

– | – | Outstanding |

| ROIC | 2010 | 25% for ROIC of 8.5% |

100% for ROIC of 10.5% |

10.3% | 92.5% | Vested and remain held pending release | |||

| EPS growth | 2010 compared to 2007 |

30% for EPS growth of 6.0% |

100% for EPS growth of 12.0% |

18.4% | 100% | Vested and remain held pending release | |||

| 30/07/07 | 778.0p | 02/03/10 | Relative TSR | 2007 to 2010 |

30% at median | 100% at upper quartile |

94th percentile (6th out of 85 companies) | 100% | 80% of shares vested. Three-quarters released on 2 March 2010 (See note 2). If after tax number of shares are retained for a further two years, the remaining quarter will be released on 30 July 2012. |

| ROIC | 2009 | 25% for ROIC of 8.5% |

100% for ROIC of 10.5% |

8.9% | 40% | ||||

| EPS growth | 2007 to 2009 compared to 2006 (see note 1) |

30% for EPS growth of 6.0% |

100% for EPS growth of 12.0% |

14.3% | 100% |

Note 1: For awards prior to 2008, EPS growth is calculated using the aggregate method that sums the results for each year and calculates the compound aggregate average annual growth assuming a constant increase on the base year throughout the period.

Note 2: Having satisfied itself that the necessary performance conditions have been met, the committee agreed that for this award the shares be released earlier than the normal vesting date of the third anniversary of the date of the award.