Pearson

- Introduction

- Strategy

- Performance

- Responsibility

- Governance

- Financials

- Other info

- Always learning

- Our strategy

Pearson’s strategy: Marjorie Scardino, chief executive

As we report on 2010, we look

back on another successful

result for our work and for our

shareholders.

Marjorie Scardino Chief executive

Marjorie Scardino Chief executiveOur world remained unsettled through the year we’ve just left. In much of the developed world it was marked by deep budget deficits, severe public spending cuts and harsh unemployment. Though ‘official statistics’ about economic progress started to look promising enough to deserve the term ‘recovery’ toward the end of the year, it doesn’t yet feel like much of a rising tide to businesses or families now facing cuts in public services, lower property values, higher taxes and demanding debts.

We were fortunate in Pearson, though. As we look back on that year, we look back on another successful result for our work and for our shareholders. We showed once again that we’re collectively capable of swimming against the current, of being a company that has the people and purpose and agility to reach our goals even when the economic flow is against us. And we turned in another set of exceptional results.

It was also, once again, a very good year for every single part of Pearson. Every one of our companies has grown well, pulled further ahead of its competitors and made progress on the long-term shift to the digital and international expansion that we’ve been pushing for. I don’t need to rehearse the figures; you can read all about them on these pages and elsewhere in this report.

One number, though, is especially important to me (and it might be to you as you think about our future prospects): while we were producing record profits, earnings and cash, we were also making our biggest-ever investment in Pearson’s future. We invested $0.8bn in new companies and a further $1.4bn organically in new education programmes, new forms of journalism, new authors and writers and most of all new technologies to make learning more personal and more effective.

As we’ve said many times, our goal as a company reaches much further than those financial measures. Our profits sustain us in our larger aim: to make an impact on people’s lives and on society through education and information. This past year we began to talk about that fundamental goal in a new way: we now say that we, like our customers, are ‘always learning’.

What have we learned in the past twelve months?

1. The world is changing shape

In 2010, China overtook Japan to become the world’s second largest economy (behind America). In 2011, they’re about to overtake the US as the world’s largest manufacturer, though India may soon leapfrog China in the category of fastest economic growth.

We’re witnessing an historic shift in economic power from developed to developing economies. This year we’ll also once again face a stark contrast between a rich world struggling with a weak and jobless recovery and an emerging world growing perhaps four times as fast. At the same time, in both worlds, we’ll likely still see a widening gap between the richest and the poorest, a gap that has a profound effect on everything from health to education to economic progress, and has to concern us in our work.

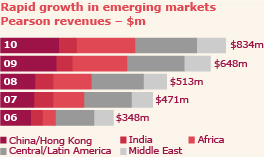

Pearson today has an important presence in many of these fast-growing markets: language schools in China; Sistemas and Penguins in Brazil; universities in South Africa; online tutoring in India, to name just four examples. We won’t slight our strong developed world businesses, but you can expect to see us investing and picking up speed in these newer places. And you can figure out that to do that we’ll need to get better and faster at moving our intellectual talent all around the world, not just from West to East, and North to South, not just to the next step on the ladder, but to build a new ladder entirely.

2. The age of digital readers has dawned. At last

Though ebooks have been around for more than two decades, I suspect publishers of all kinds will look back on 2010 as the ‘lift-off’ for digital reading. Apple with its iPad sparked a lot of the buzz. But the real phenomenon was the quick emergence of a symbiotic community of multi-purpose devices, ebook formats and sales channels. There’s now genuine consumer demand for high-quality digital reading (and learning) experiences, and we’re beginning to deliver them in earnest.

At Penguin, for example, ebook sales almost trebled over the course of 2010 (having increased four-fold in 2009) and now represent more than $1 in every $20 of Penguin’s total global sales (and much more in the US). At the FT, another example, digital subscribers topped 200,000 as the year ended, and also brought in more print subscribers. And in our education companies, demand for our combination of ebooks and our digital learning platforms – eCollege, MyLabs, to name only two – has been growing fast, but this past year that pace exploded.

In fact across Pearson, just as we see developing economies growing several times faster than those in the developed world, so we see a similar contrast between our digital services and our more traditional, print-only products.

3. Information wants to be valuable

For a few years now, the idea that ‘information wants to be free’ – that consumers won’t pay for content in a hyper-connected digital world – has echoed ‘round the ether’. We resisted that movement, believing rather unfashionably that high quality content costs real money to create and should be worth paying for if that money is well-spent. The pendulum swung back in our direction last year, as other media companies began to experiment with paid-for online services and as the app economy helped stimulate the market for digital reading.

I’m proud that we held our ground and proved that, if the content and the experience is good enough, users are willing to pay. But we can’t say that we’ve won the argument on all counts. In some parts of the world, we face potential changes to copyright and intellectual property laws that might weaken the ability of authors and publishers to generate a return from their creative endeavours, and in turn weaken incentives to invest.

And in some cases, what we publish is a commodity or so generally important that we ought to find a way to make it available more widely and easily, and take a different account of its value.

All of that means that we have to keep an open mind about the terms under which we create and sell our content and services. And we have to make our piece of this digital and mobile world easy for people to access and connected to what else they do and who they do it with.

We also have to work to educate people on the value of intellectual property in an economy based on brain-power. The first step, of course, is to respect intellectual property ourselves (which reminds me to give due credit to the FT’s media editor, who wrote that headline above – ‘Information wants to be valuable’).

4. Trust is precious

Part of the fall-out from the global financial crisis was a scepticism of the motives of large corporations – not just banks, but companies like ours. As the year went on, that rumbling scepticism became more than a rumble, as several companies that made headlines can attest.

Though the nature of Pearson’s business is very different from those companies, we’re arguably more dependent on the public’s trust than most. Readers of the FT trust its editorial integrity and independence; customers of Penguin trust it to be a mark of exceptional quality; teachers and students trust our learning programmes (on paper or screens) to be effective and engaging and our testing, qualifications and services to be reliable, rigorously accurate and helpful.

What we all understand is that trust can never be taken for granted: it’s something that all of us – every single one of us – have to go out and earn every day.

Those are four of the lessons I think 2010 taught us (some probably for the second or third time).

None of those lessons is new; we’ve been tracking those trends and shaping our strategy around them for some time. So we were pretty well-prepared to stare down those changes and to use them to fuel our growth.

Our strategy

That strategy (which I’ve been writing to you about for so many years you’re probably tired of hearing it) is pretty simple:

- 1. We develop an idea, a story, a lesson, a premise (quality content), determined that it should be both unique and respected;

- 2. We add services, generally enabled and delivered by technology, to make that content more useful and more valuable;

- 3. We work in markets around the world, with an increasing emphasis on those in the developing world;

- 4. Those first three priorities all require consistent investment. We make room for that investment through efficiency gains, measured in margin and working capital improvements.

Because I’ve written about this strategy every year for the past 12, you may be lulled into a sense that everything is stable; but that would be a false sense. That same strategy is not a description of business-as-usual. It’s a manifesto for disruption, for constant change, and for the kind of radical corporate reinvention that’s required in a world that’s changing before our eyes (and often, too fast for us to perceive the change).

Our strategy

1

Long-term organic investment in content

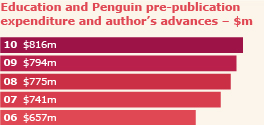

Over the past five years, we have invested £4.0bn in our business: new education programmes; new and established authors for Penguin; the FT Group journalism. In 2010, that investment reached an all-time high of approximately £0.9bn. We believe that this constant investment is critical to the quality and effectiveness of our products and that it has helped us gain share in many of our markets.

2

Digital products and services businesses

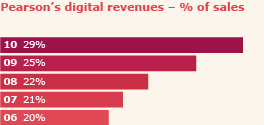

Our strategy is to add services to our content, usually enabled by technology, to make the content more useful, more personal and more valuable. These digital products and services businesses give us access to new, bigger and faster-growing markets. In 2010, our digital revenues were £1.6bn or 29% of Pearson’s total sales. Our worldwide educational testing businesses have increased their revenues almost 70% over the past five years to $1.7bn.

3

International expansion

We are already present in more than 70 countries and we are investing to become a much larger global company, with particular emphasis on fast-growing markets in China, India, Africa and Latin America. Over the past five years, our international education business has grown headline sales at an average annual rate of 18% through strong organic growth and acquisitions, generating more than £1.2bn of revenues in 2010.

4

Efficiency

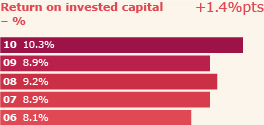

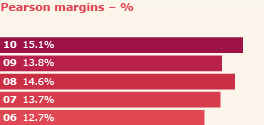

Our investments in content, services and new geographic markets are fuelled by steady efficiency gains. Since 2006, our operating profit margins have increased from 12.7% to 15.1% and our ratio of average working capital to sales has improved from 26.3% to 20.1%.

Pearson 2011

So we know we’ll need to reinvent ourselves again in 2011. We’ve already witnessed events that congealed our conviction that we can’t rest our hopes for the future on doing what we did or how we did it in the past. We have to keep on learning new lessons; to keep learning and changing before we really think we need to.

That kind of change is a lot to ask against the backdrop of a world economy that remains at best ‘uncertain’ and at times ‘troubling’. But our success over the past six years has been based on bucking the tide, doing new things. We don’t for a minute take that success for granted; but we are as determined as ever that it will continue. And we thank all shareholders – large and small, institutional and private, Pearson employees, former employees and pensioners – for your continued commitment to the company. We’re very focused on ensuring your commitment is rewarded; and we never forget that it is your investment that makes it possible for us to pursue the goals and the change that we are hell-bent on achieving.

Marjorie Scardino Chief executive