Pearson

- Introduction

- Strategy

- Performance

- Responsibility

- Governance

- Financials

- Other info

- Always learning

- Introduction

Chairman’s statement

We have a clear strategy, a talented

team and a proud record of performance.

Once again, that was rewarded with good

returns for shareholders.

Glen Moreno Chairman

Glen Moreno ChairmanDear shareholder,

Welcome to our report to you for 2010.

It was another challenging year for your company. The global economy did begin to crawl out of recession, but governments, businesses and consumers continued to suffer the aftershocks of the financial crisis. Confidence was in short supply, and my own guess is that it’s likely to remain that way for some time.

But once again, Pearson rose to the challenge. As you’ll have seen, your company posted operating profit and earnings growth of 15% and 19% respectively. Beneath those numbers for all of Pearson stand excellent results in all parts – Penguin, the Financial Times Group and our education company. For that, all our talented people deserve every credit.

On two especially important performance measures – operating cash flow and return on capital – we hit all-time highs of £1.06bn and 10.3% respectively. And much more important than any single year, this continues a trend of consistent, reliable growth through good times and bad. Over the past five years, our profits, earnings per share and free cash flow have all doubled.

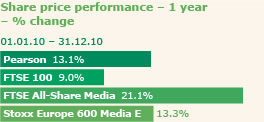

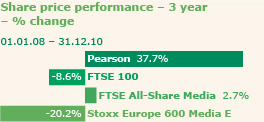

Once again, that strong operational performance was rewarded with good returns for shareholders. After a substantial increase of almost 40% in 2009 our shares began 2010 at 891p. They ended the year 13% higher, just above ten pounds. That growth was a little faster than the overall market (the FTSE 100 was up 9%) but a little slower than our sector as advertising-funded companies that had been hit hard during the recession enjoyed a sharp recovery (the DJ Stoxx 600 Media index was up 13% and the FTSE All-Share Media index 21%).

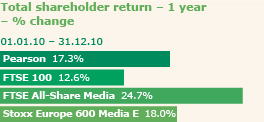

The second element of our return to shareholders – the dividend – was further increased in 2010. So our total shareholder return (which combines both the share price movement and dividends paid) was up 17% for the year – this coming on top of a gain of close to 50% in 2009. Again, this was ahead of the FTSE 100 (up 13%), but behind the DJ Stoxx 600 Media (up 18%) and the FTSE media sector (up 25%).

So, there is much to be proud of and I convey my thanks and congratulations to everyone at Pearson. But we cannot look back: our markets are filled with change and we have much to be cautious about.

The economic recovery is not assured and in many parts of the world debt – both public and private – remains a heavy burden. At the same time, the disruptive transformations that have been reshaping Pearson for some time – slower growth in our traditional markets set against rapid expansion in the so-called ‘developing’ world; and the revolutionary impact of connected digital technologies on the way we all read, learn and communicate – are snowballing. These twin forces – technology and globalisation – have been the dominant trends throughout my business career and Pearson’s strategies, opportunities and risks are to a very great extent shaped by them. As reliable as our growth has been, we cannot take it for granted; as Marjorie writes in her strategy review, we have to keep on investing and changing.

These are the strategic matters that consume the attention of our people and the board. Your board believes it can contribute most to Pearson’s success by focusing on four key themes: governance, strategy, business performance and people. Our annual board cycle and meeting agendas are formally structured around these things.

Governance

As a board, our belief is that good governance supports the long-term development of strategy and good performance. We are determined not to second-guess a highly experienced and effective executive management team; but we do believe that robust, open board debate brings a discipline to important decisions and adds a valuable and diverse set of external perspectives.

We’re fortunate to have a varied group of non-executive directors drawn from successful businesses and education institutions with deep experience of global corporate strategy, education, consumer marketing and technology. Terry Burns’s decision to depart from the board last year, soon followed by the untimely death of CK Prahalad, left us with an unexpected imbalance between executive and non-executive directors. We have addressed this with the recent appointment of Josh Lewis as a non-executive director. We believe Josh will make an excellent addition to our board. We are currently looking to make one further non-executive director appointment.

Strategy

At each board meeting your board reviews the detailed strategy and long-term plans for one or more of our businesses. Once a year, at a specific two-day meeting, the board considers Pearson’s overall strategy. We analyse in detail the market conditions and trends facing us, and consider the long-term goals and plans of all parts of Pearson. We have an open and robust debate over major strategic issues such as the shape of the company, the potential value to be created by further acquisitions and disposals, and the priorities for capital allocation and organic investment. Marjorie’s letter to shareholders, which begins here, is as always an excellent summary of our strategic direction.

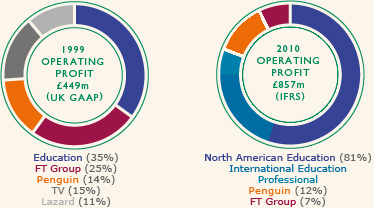

As I wrote in my letter to shareholders last year, Pearson is a company that has totally transformed itself over the past decade. Yet even by our standards, 2010 was a year of dramatic change. As a board we debated and approved Pearson’s largest disposal ever: the $2.0bn sale of our stake in Interactive Data to Silver Lake and Warburg Pincus. We looked at all the acquisitions that the company made during the year – including significant investments to expand our position in fast-growing developing markets such as Brazil, India and Africa. And we also, as a matter of routine, revisited acquisitions made in prior years to assess their performance against the plans originally laid out for them. In 2010, in addition to reviewing returns and lessons learned from capital allocation decisions over the past seven or so years, we conducted detailed post-acquisition reviews of acquisitions completed during 2008.

I am convinced that this steady reallocation of resources into learning companies that are heavily oriented towards developing markets and new technologies is an excellent strategy for Pearson to pursue. Our return on capital from all acquired companies from 2002–2010 is 12%, well above our average cost of capital.

Business performance

At the start of each year, in addition to reviewing long-term strategic plans, the board debates and agrees a stretching-but-realistic one-year operating plan. It focuses on a balanced mix of financial goals – sales growth, margins, earnings, cash and working capital reduction – which are intended to contribute to the long-term financial goals of the company, to align executive compensation with shareholders’ interests and to avoid an excessive focus on any single financial measure. These targets in turn form the basis of our expectations for the year and for executive compensation. At every board meeting, we hear from the company’s chief financial officer and executive directors on the company’s business performance relative to plan.

This past year, in monitoring business performance the board has paid particularly close attention to risk management. You can read our full discussion of the material risks affecting the company here; they are dominated by risks related to a prolonged period of low economic growth and the transformational shift towards digital delivery and business models.

People

Your board is keenly aware that a creative business like Pearson is acutely dependent on its internal talent – not just of a small group of senior directors, but of a wide pool of writers, editors, educators, publishers, technologists, marketers and sales experts.

Each year we devote one full board meeting to talent, succession planning and organisational structure. We look in detail at the 20 most senior jobs in Pearson, ensuring that there are several credible candidates for each role, that they are well known by the board and that we have development plans in place to round out their experience and skills and to give them every possible chance of progressing their careers at Pearson.

In addition, in 2010 the board reviewed the goals and plans of Pearson’s new director for people, Robin Baliszewski. And the remuneration committee, as always, played the pivotal role in setting overall compensation policy, senior executive reward and incentive targets across the company aligned to our strategy and performance. You can read the full report of our remuneration committee here.

In 2010, in addition to my Pearson responsibilities, I took on a new role as deputy chairman of the Financial Reporting Council, the UK’s independent regulator responsible for promoting high quality corporate governance and reporting. In that capacity I have become even more aware of the desire of shareholders, large and small, to understand how boards are spending their time and how they are ensuring that key decisions around investment, performance and compensation are closely connected to strategy.

I do hope that this report helps provide you with that understanding in relation to Pearson. We have a clear strategy, a focused board, a talented team and a proud record of performance. We will be straining every sinew to continue to build on all those strengths in 2011.

If you have any questions, I invite you to send them to us via our website at www.pearson.com; or to join us in person at our annual shareholders’ meeting.

![]()

Glen Moreno Chairman